The agi calculation is relatively straightforward.

Agi floor is asjusted.

Adjusted gross income agi is a measure of income calculated from your gross income and used to determine how much of your income is taxable.

Your adjusted gross income agi is an important number come tax time especially if you re planning to e file.

Using income tax calculator simply add all forms of income together and subtract any tax deductions from that amount.

Calculating your adjusted gross income agi is one of the first steps in determining your taxable income for the year.

Agi s floor system are extremely strong and easy to install our full floor aeration system is the best way to protect your grain.

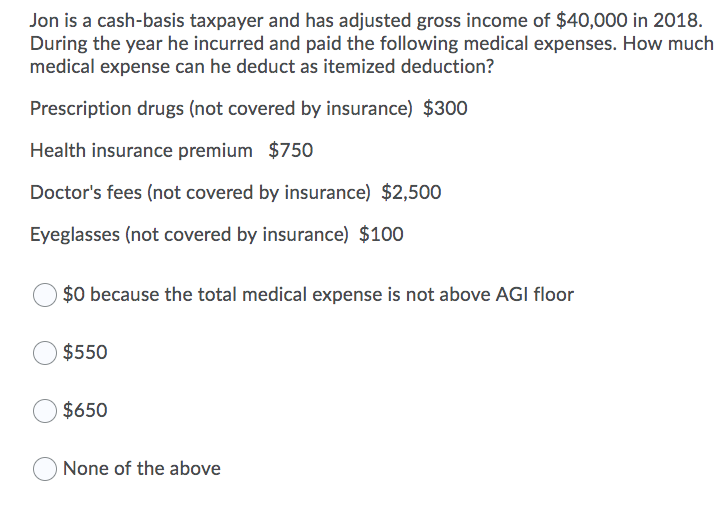

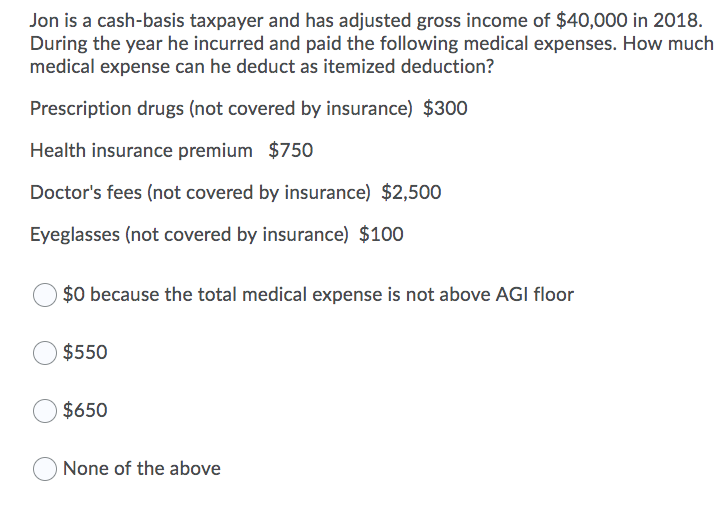

1150 600 550 line 26 of schedule a even though he had expenses totaling 1150 because these particular expenses were subject to the 2 rule his net deduction that he will receive on his return for.

Modified adjusted gross income not adjusted gross income will be used in determining eligibility for your health insurance tax credits.

02 x 30 000 600 line 25 of schedule a subtract 2 of his agi from his deductions that are subject to the rule.

Adjusted gross income agi is defined as gross income minus adjustments to income.

Modified adjusted gross income is a measure used by the irs to determine if a taxpayer is eligible to use certain deductions credits or retirement plans.

Depending on your tax situation your agi can even be zero or negative.

Your adjusted gross income agi is your gross income minus certain deductions also known as adjustments.

It not only determines your tax bracket but also tells you which credits you.

It is the starting point.

How to calculate adjusted gross income agi.

Figure 2 of his agi.

Adjusted gross income agi.

Your agi isn t the same as your taxable income but finding your agi is a necessary intermediate step for determining your taxable income.

Not only does it impact the tax breaks you re eligible for your agi is now also a kind of identification.

Adjusted gross income agi or your income minus deductions is important when calculating your total tax liability.

Adjustments to income include such items as educator expenses student loan interest alimony payments or contributions to a retirement.

For tax years beginning 2018 the 1040a and ez forms are no longer available.