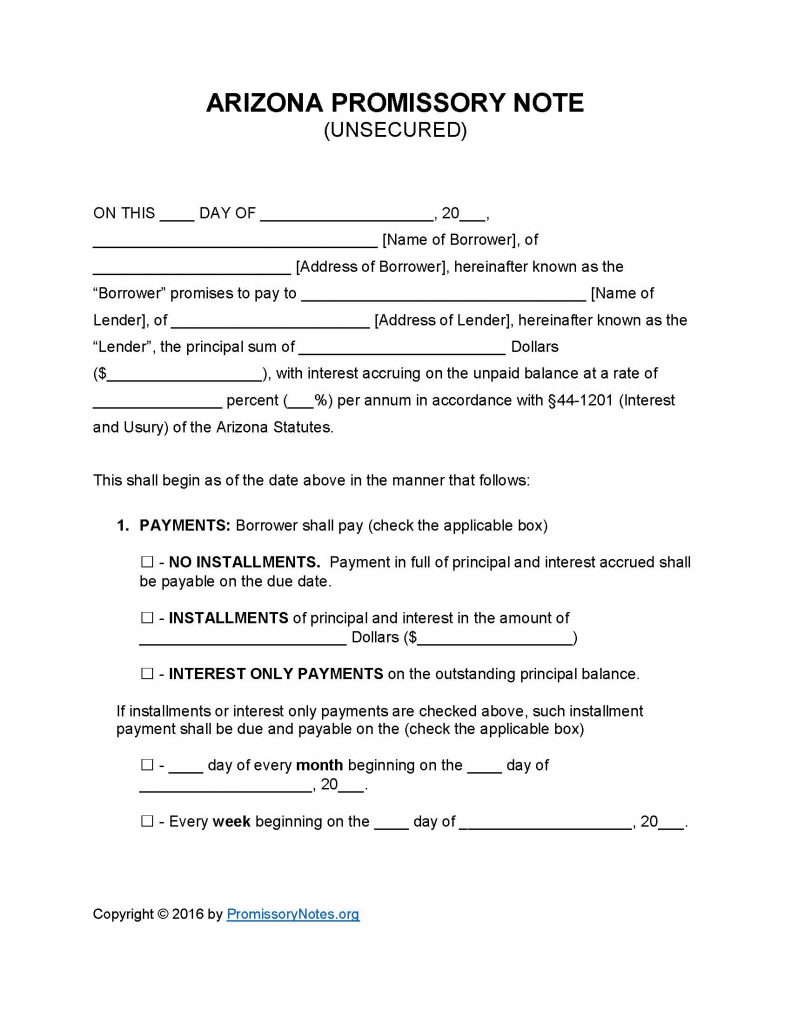

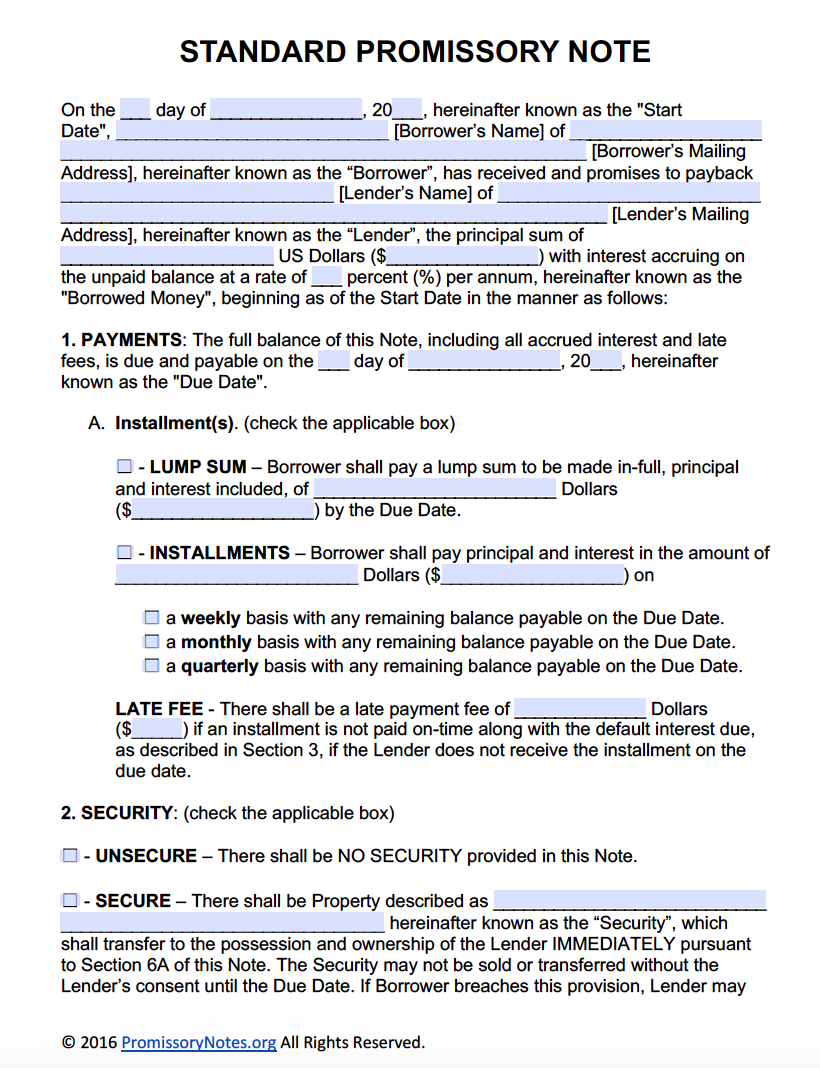

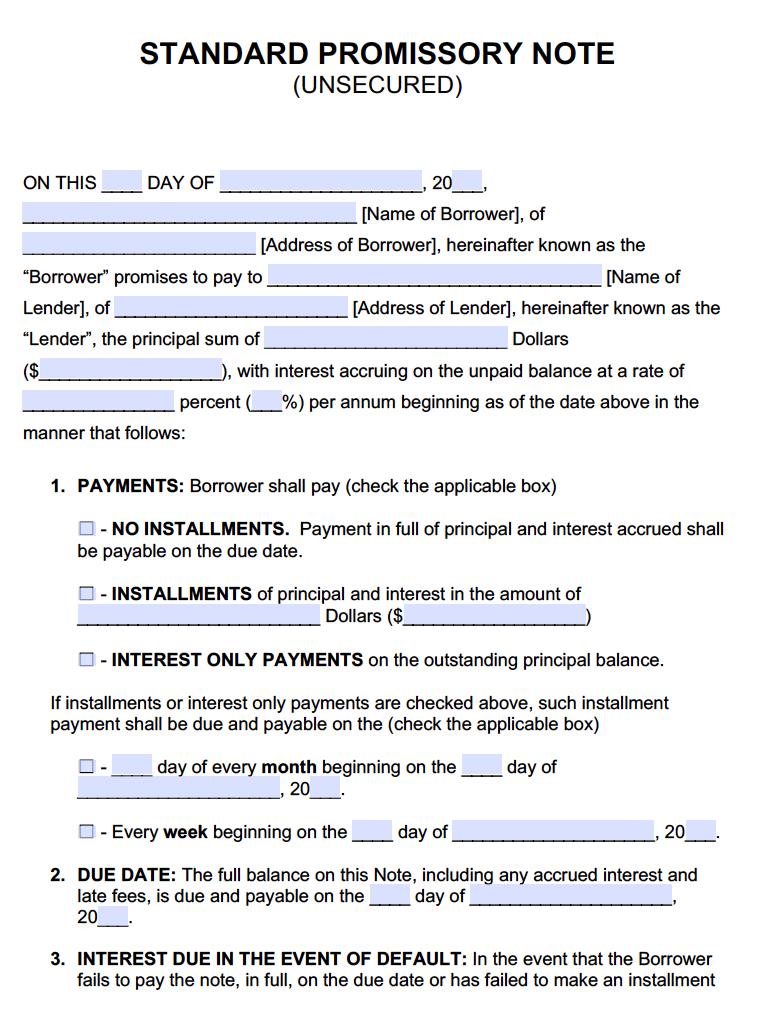

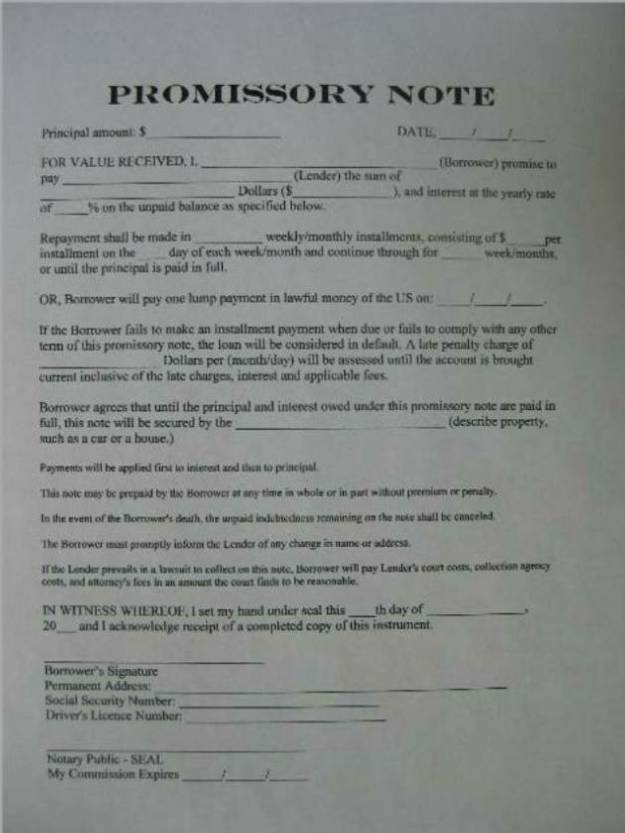

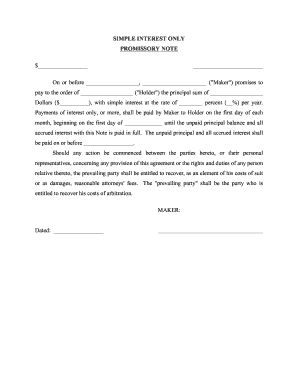

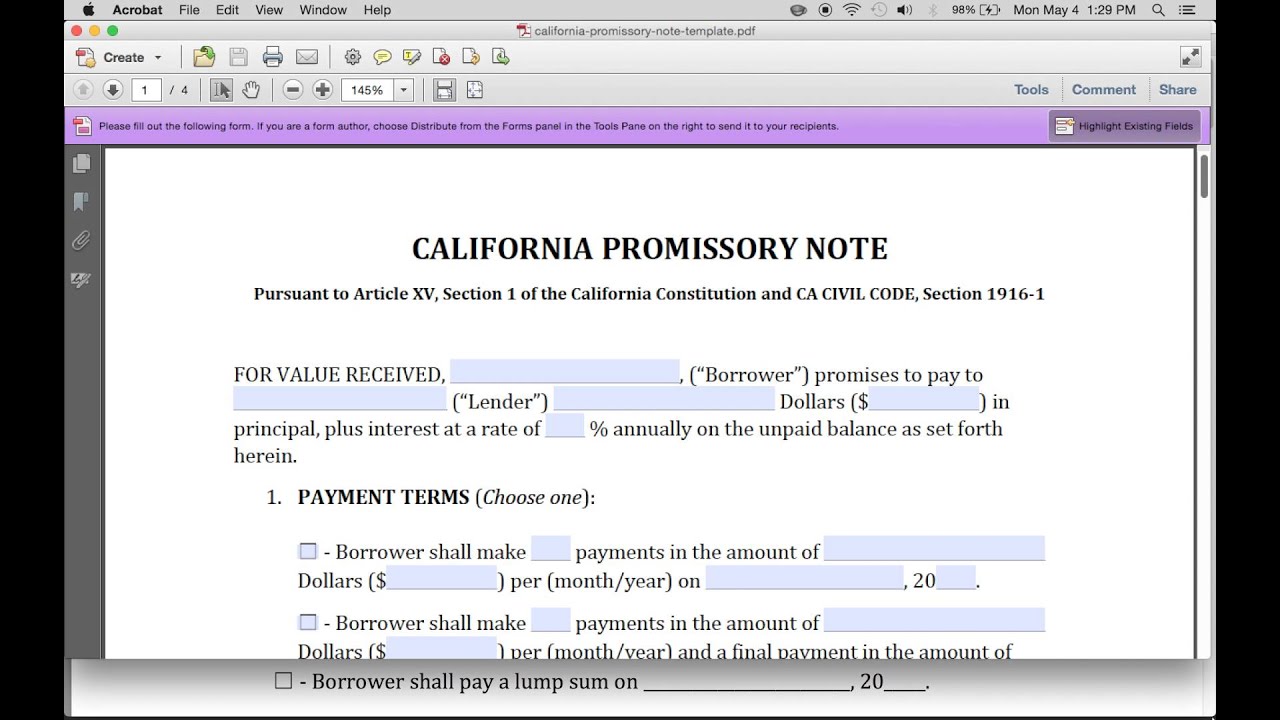

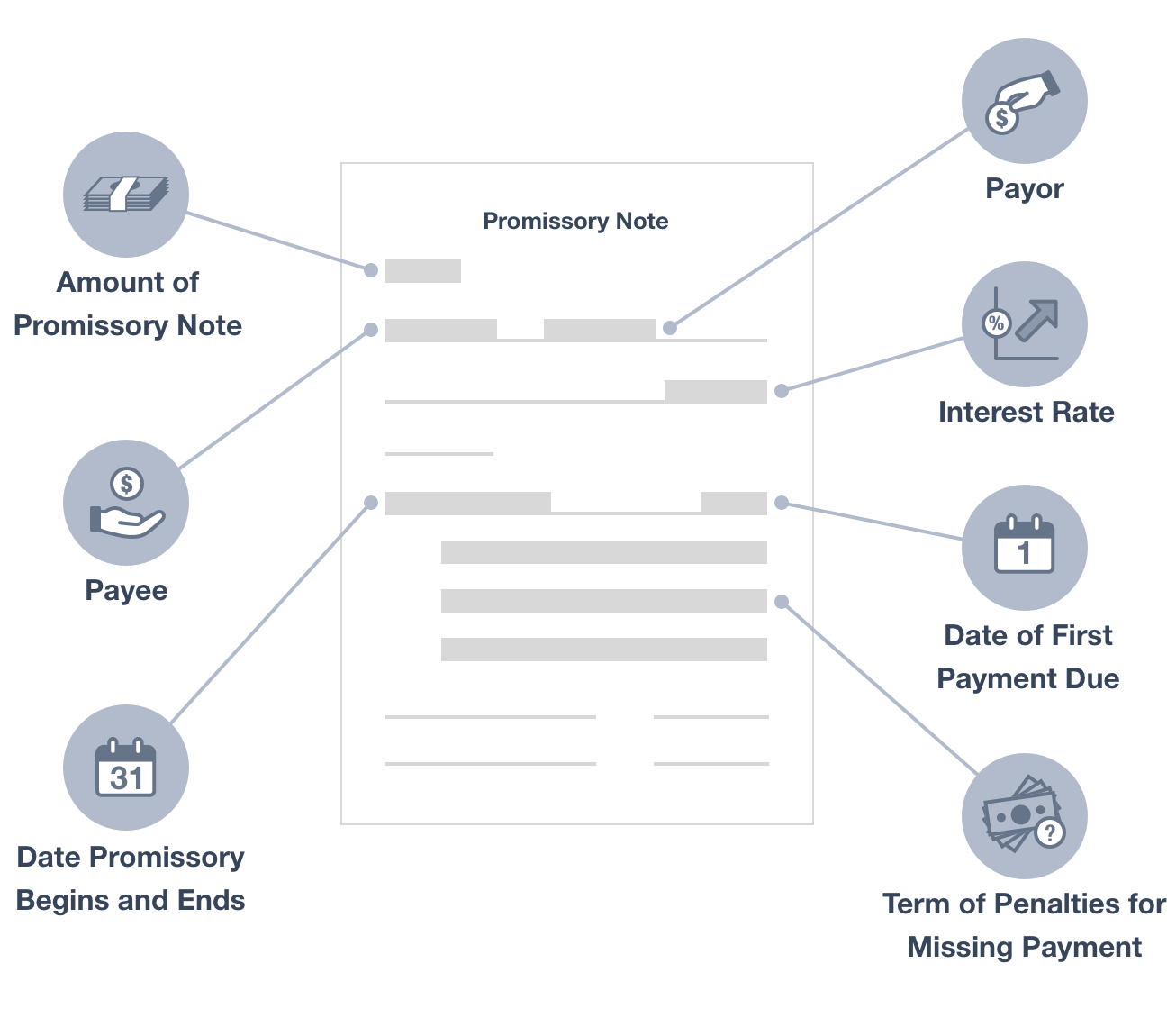

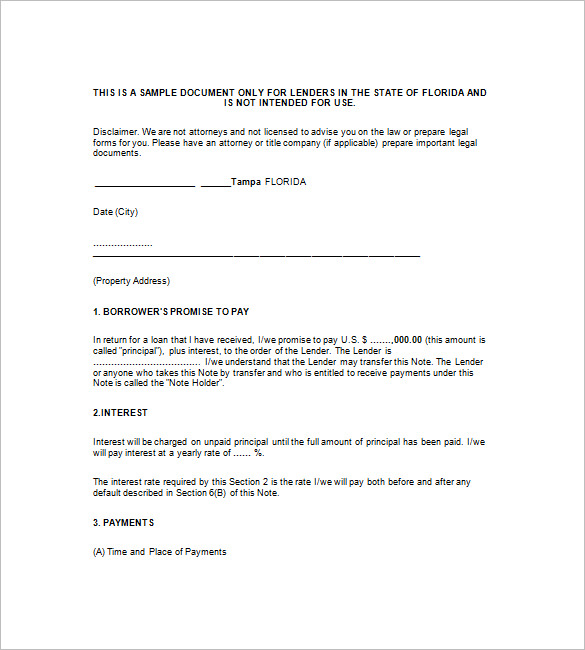

Both the secured and unsecured versions record the parties personal information such as their names and addresses as well as the specifics of the agreement such as interest rates final due dates and installment options.

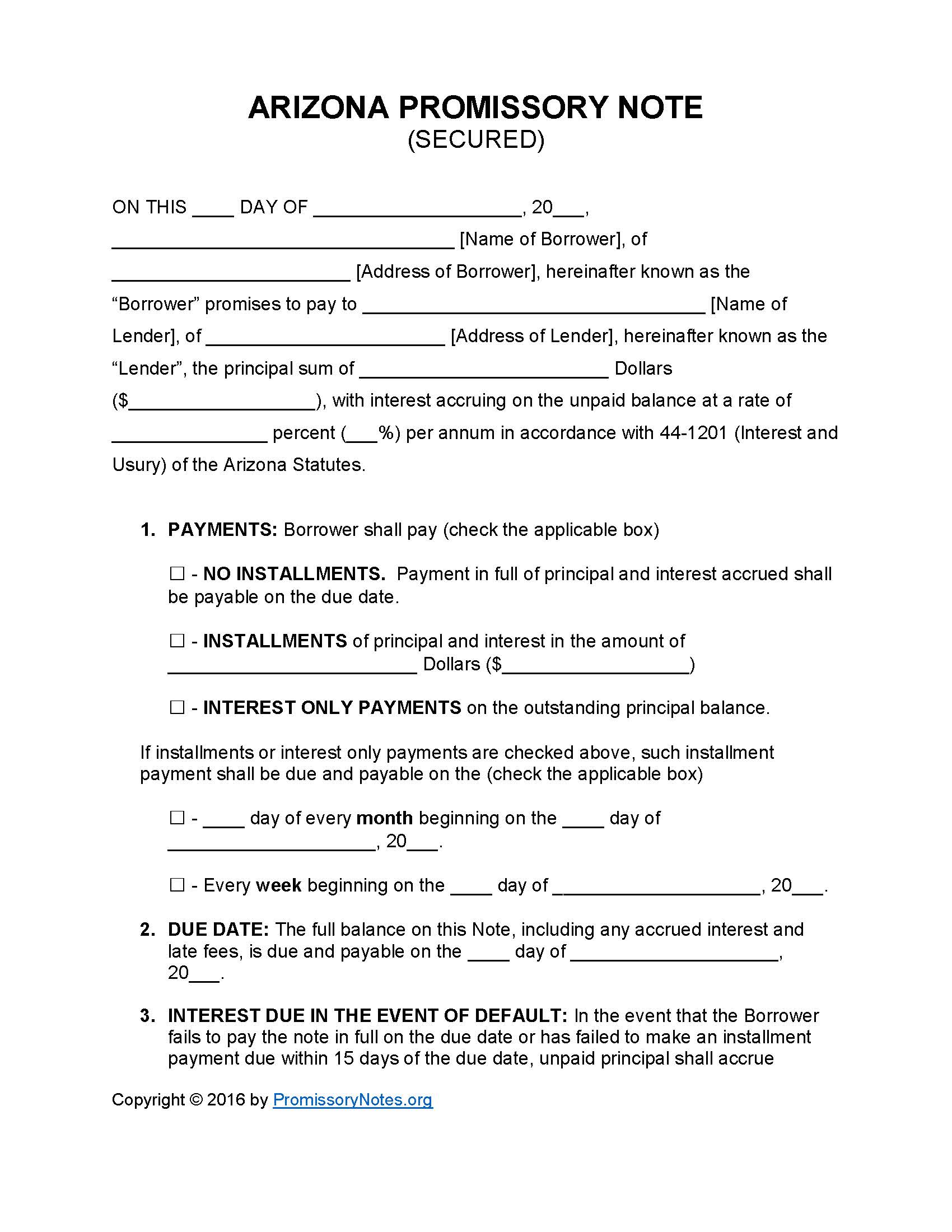

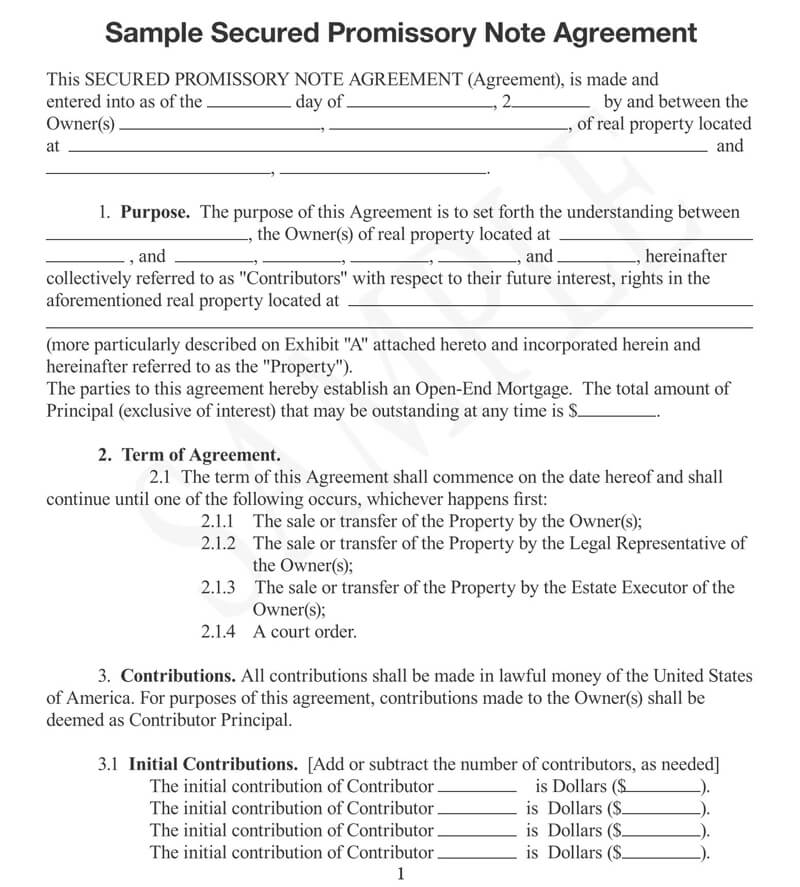

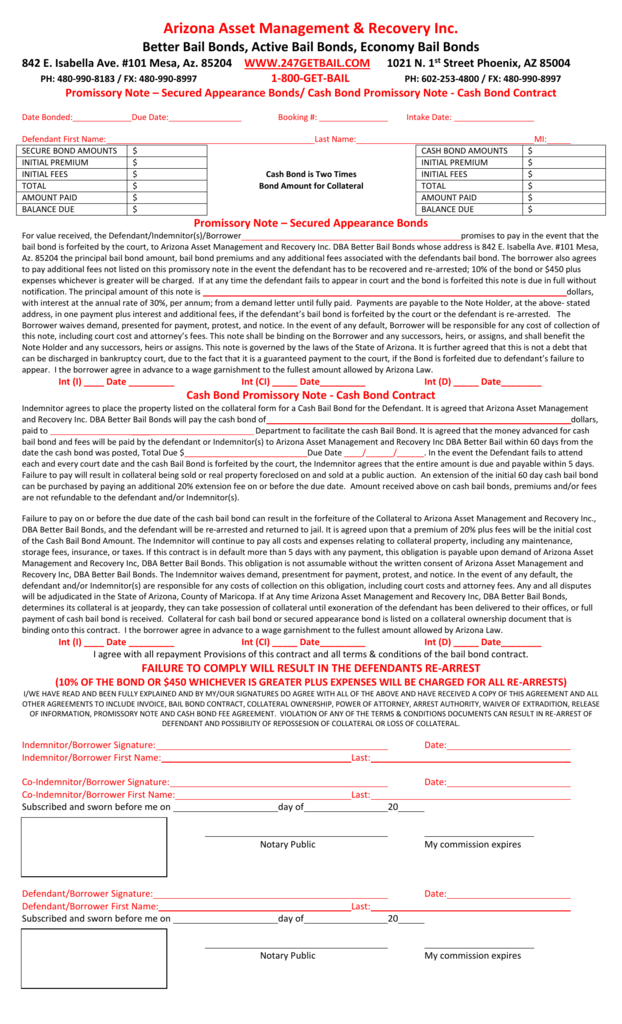

Arizona secured promissory note.

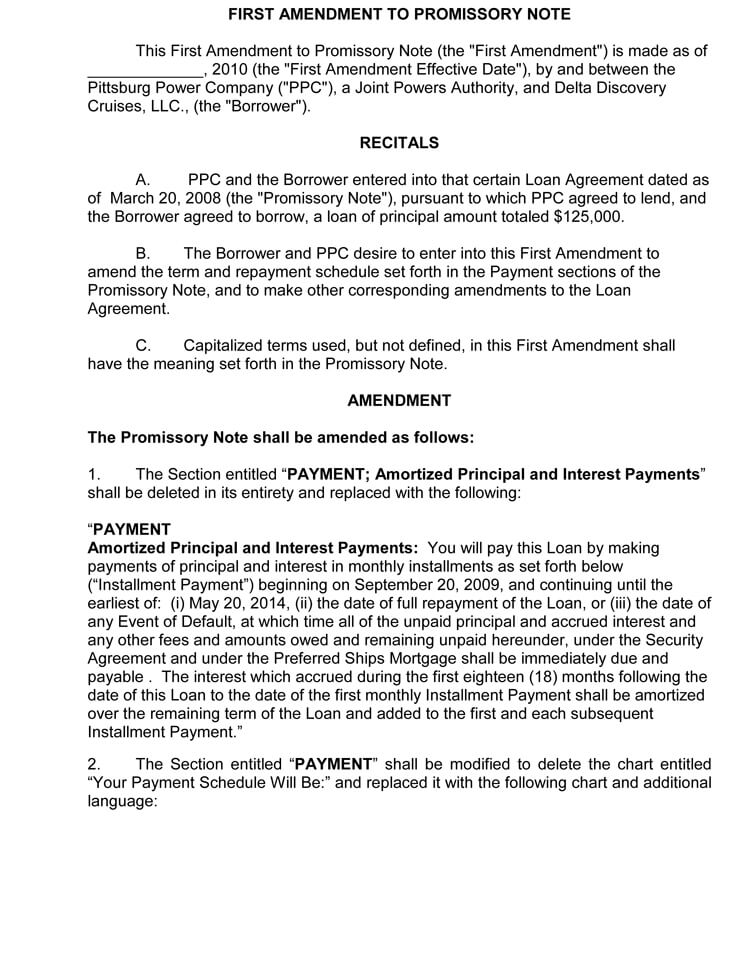

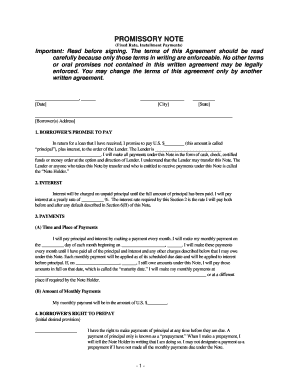

A promissory note or a contract between a lender and a borrower must conform to arizona state laws that regulate the amount of interest that can be charged on the loan or usury laws as well as the state s statute of limitations or the length of time the contract can be enforced.

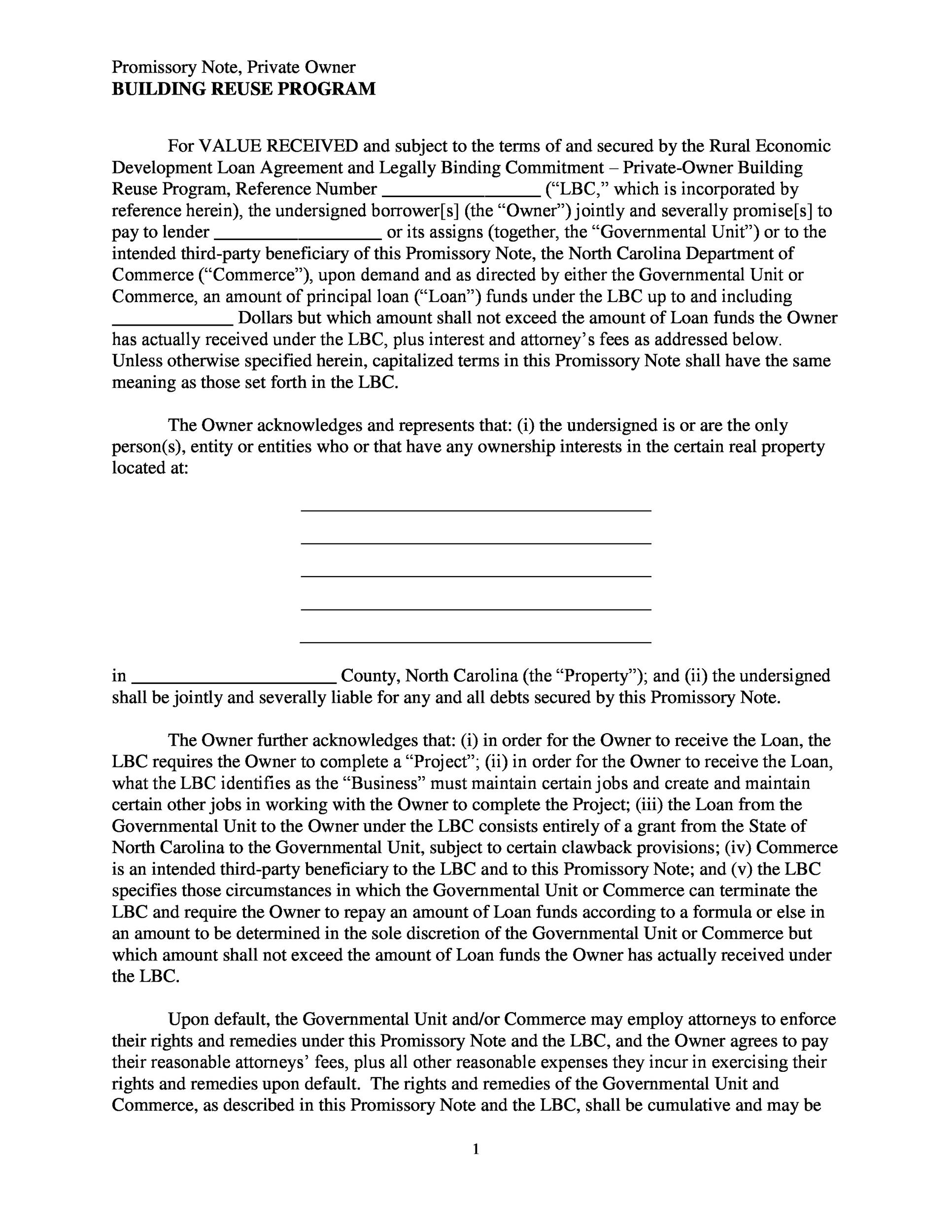

Secured notes require that the borrower provide collateral.

Because the agreement is secured the lender has a form of security in the possible outcome the borrower defaulting on the agreement.

The arizona secured promissory note is a documented promise stating one party the lender will pay another party the borrower a previously established amount of money in exchange for the same amount of money in addition to interest.

The arizona promissory note templates are documents that solidify the act of a loan being offered by the lender to the borrower.

The arizona secured promissory note is a contractual document that is entered into by a lender and a borrower.

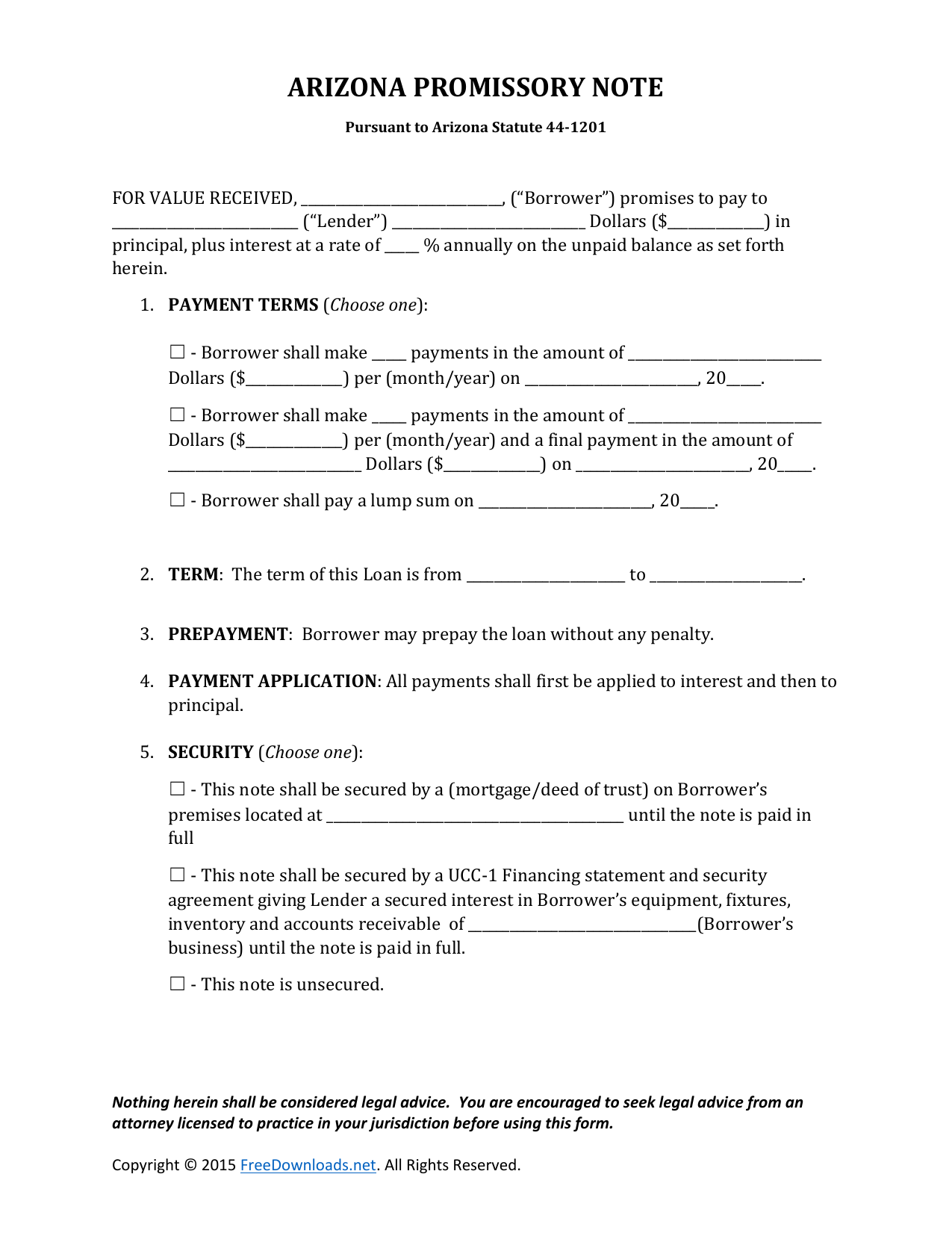

This form allows the user to choose whether or not the loan will be secured or unsecured and the method of payment.

When a promissory note is secured it means that the borrower promises that if they do not pay off the loan that will give over some piece of property known as collateral to the lender to satisfy at least part of the loan.

Download the arizona promissory note form in order to document an agreement between an individual who lends funds to an individual who promises to pay the funds back within a specified time period with a specified amount of interest.